Depreciation is a crucial accounting concept that represents the reduction in the value of an asset over time due to wear and tear, obsolescence, or other factors. For businesses that rely heavily on electrical equipment, understanding the depreciation rates is essential for accurate financial reporting, tax planning, and investment decisions. This article delves into the intricacies of depreciation rates for electrical equipment, providing a comprehensive guide for professionals in finance, accounting, and asset management.

The Importance of Depreciation

Depreciation plays a pivotal role in financial accounting by spreading the cost of an asset over its useful life. This ensures that the expense is matched with the revenue generated by the asset, adhering to the matching principle of accounting. For electrical equipment, which often represents a significant capital investment, accurate depreciation calculations are vital for reflecting true financial performance and ensuring regulatory compliance.

Factors Influencing Depreciation Rates

Several factors influence the depreciation rates of electrical equipment:

Initial Cost: The purchase price and any additional costs associated with bringing the equipment into operational condition form the basis for depreciation calculations.

Useful Life: This is the estimated period over which the equipment is expected to be productive. For electrical equipment, useful life can vary widely depending on the type of equipment, usage patterns, and technological advancements.

Salvage Value: The estimated residual value of the equipment at the end of its useful life. For electrical equipment, salvage value can be minimal due to rapid technological obsolescence.

Depreciation Method: Various methods can be used to calculate depreciation, including straight-line, declining balance, and units of production. Each method has its advantages and is suitable for different types of assets and business scenarios.

Technological Advancements: Rapid advancements in technology can render electrical equipment obsolete quickly, affecting its useful life and, consequently, its depreciation rate.

Usage and Maintenance: The intensity of use and the quality of maintenance can significantly impact the lifespan and depreciation rate of electrical equipment. Well-maintained equipment may depreciate slower than equipment that is heavily used and poorly maintained.

Common Depreciation Methods

Straight-Line Depreciation: This is the simplest and most widely used method. The cost of the equipment is evenly spread over its useful life. The formula for straight-line depreciation is:

Straight-Line Depreciation: This is the simplest and most widely used method. The cost of the equipment is evenly spread over its useful life. The formula for straight-line depreciation is:

Annual Depreciation Expense= (Cost of the Asset−Salvage Value )/ Useful Life

Declining Balance Method: This method accelerates depreciation, allowing for higher expenses in the earlier years of the asset’s life. The double-declining balance method is a common variant, calculated as:

Annual Depreciation Expense=2× Net Book Value at Beginning of Year /Useful Life

Units of Production Method: This method ties depreciation to the actual usage of the equipment. It is particularly useful for equipment whose wear and tear are more closely related to operational hours or production output than time. The formula is:

Depreciation Expense=( Cost of the Asset−Salvage Value)×Actual Production/Total Estimated Production

Depreciation Rates for Different Types of Electrical Equipment

Electrical equipment encompasses a broad range of assets, each with its specific depreciation considerations. Here’s a look at some common categories:

Computers and Office Equipment: Typically, these assets have a shorter useful life due to rapid technological advancements. The useful life is generally estimated between 3 to 5 years, with a higher depreciation rate applied.

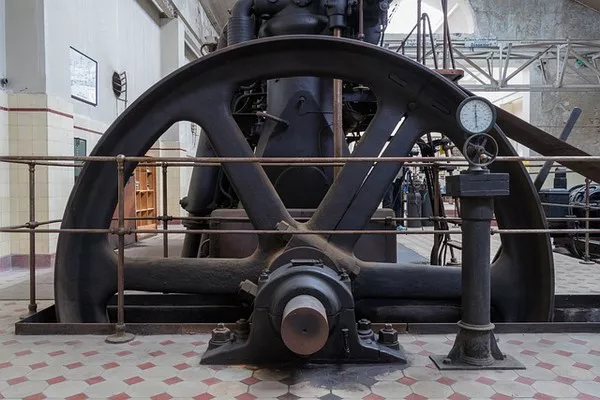

Manufacturing and Industrial Equipment: This category includes machinery used in production processes. These assets often have a longer useful life, ranging from 7 to 15 years, depending on the industry and usage intensity.

HVAC Systems and Power Generators: Such equipment is crucial for operational stability and can have a useful life between 10 to 20 years. Depreciation rates for these assets are usually lower compared to office equipment.

Medical and Laboratory Equipment: Given the precision and technological integration in these assets, their useful life can vary significantly. Generally, it ranges from 5 to 10 years.

Consumer Electronics: For businesses dealing in retail or rentals, consumer electronics like TVs, audio systems, and appliances typically have a shorter useful life, often between 2 to 4 years.

Tax Implications and Regulatory Considerations

Depreciation also has significant tax implications. In many jurisdictions, businesses can deduct depreciation expenses from their taxable income, which can result in substantial tax savings. Different countries and regions may have specific regulations and allowable methods for calculating depreciation. For instance, the Modified Accelerated Cost Recovery System (MACRS) is used in the United States for tax purposes, which allows for accelerated depreciation under certain classes of assets.

Challenges in Depreciating Electrical Equipment

Technological Obsolescence: The rapid pace of technological change can make it challenging to accurately estimate the useful life of electrical equipment.

Usage Variability: Different usage patterns can lead to significant variations in wear and tear, complicating the estimation of depreciation rates.

Maintenance Practices: Varying maintenance practices can affect the lifespan and depreciation of equipment, making standardization difficult.

Regulatory Changes: Changes in tax laws and accounting standards can impact the calculation and reporting of depreciation expenses.

Best Practices for Managing Depreciation of Electrical Equipment

Regular Reviews and Updates: Periodically review and update the useful life and residual values of electrical equipment to ensure accurate depreciation calculations.

Utilize Technological Tools: Leverage asset management software to track the condition, usage, and maintenance of electrical equipment, which can provide more precise data for depreciation calculations.

Consult with Experts: Engage with accounting professionals and tax advisors to ensure compliance with relevant laws and to optimize depreciation strategies.

Plan for Replacement: Incorporate depreciation insights into capital budgeting and asset replacement planning to ensure that the business remains operationally efficient and financially sound.

Stay Informed: Keep abreast of changes in technology and regulatory environments that could affect the depreciation rates of electrical equipment.

See also What Are The Hazards Of Using Electrical Equipment

Conclusion

Depreciation is a fundamental aspect of financial management for businesses that rely on electrical equipment. Understanding the factors that influence depreciation rates, the methods of calculating depreciation, and the implications for financial reporting and tax planning is essential for accurate financial management. By implementing best practices and staying informed about technological and regulatory changes, businesses can effectively manage the depreciation of their electrical equipment, ensuring long-term financial health and operational efficiency.