In a significant announcement today, UK Chancellor of the Exchequer Jeremy Hunt presented the Budget Statement, featuring pivotal initiatives aimed at bolstering the manufacturing sector and promoting research and development (R&D) in the country.

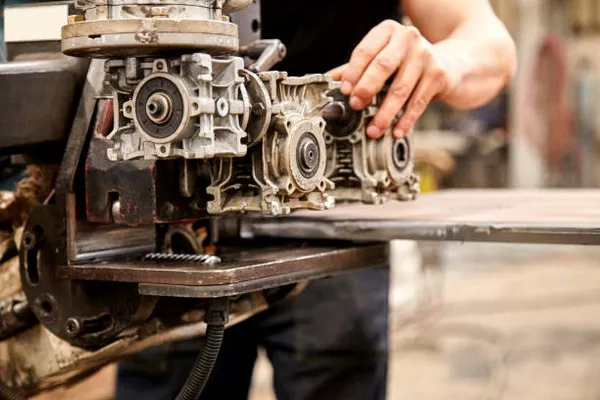

One notable revelation is the inclusion of leased machinery in the Full Expensing capital allowance. The upcoming draft legislation is set to extend Full Expensing, a £10 billion tax cut annually, to leased assets, strengthening the capital allowance regime. This move is particularly laudable for its potential to reduce the in-year cost of plant or machinery by 25%.

Implemented in April 2023, Full Expensing allows companies subject to UK corporation tax to receive a 100% first-year tax deduction for qualifying plant or machinery expenditures. This permanent measure succeeds the Super Deduction, reflecting the government’s commitment to supporting businesses in their investment endeavors.

Commenting on the leasing consultation, Fhaheen Khan, senior economist at Make UK, commended the government’s commitment to exploring innovative ways to make the UK an attractive investment location. Khan highlighted the potential benefits for smaller manufacturers and urged further exploration into expanding Full Expensing to cover refurbished, second-hand technologies, aligning with sustainability goals.

Additionally, the Budget included a substantial injection of £360 million to boost British manufacturing and R&D. A notable component is the £200 million joint investment in zero-carbon aircraft technology, aiming to foster a more sustainable aviation sector.

The automotive sector also received attention, with almost £73 million in combined government and industry investment allocated for cutting-edge automotive R&D projects. This funding, supported by more than £36 million from the Advanced Propulsion Centre UK (APC) competitions, emphasizes the development of electric vehicle technology and aims to solidify the UK’s position as a global hub for EV manufacturing.

Stephen Phipson, chief executive of Make UK, welcomed the Budget, emphasizing the building blocks of an industrial strategy. He highlighted the extension of Full Expensing to leased assets as a particularly beneficial measure for smaller companies, urging prompt draft legislation to make this provision permanent.

Faye Skelton, head of policy at Make UK, applauded the extension of the Recovery Loan scheme, acknowledging its significance in supporting small businesses, especially those within the manufacturing base.

CEO of Made in Britain, John Pearce, praised the reduction in the tax burden on British workers and welcomed devolved powers for business growth in regions, emphasizing the positive impact on manufacturing across the country.

In the automotive sector, Mike Hawes, SMMT chief executive, expressed disappointment at the lack of measures to stimulate consumer demand for electric vehicles. He urged the government to consider reducing VAT on new EVs and revising vehicle taxation to encourage the transition to electric vehicles.

The Budget’s focus on R&D and manufacturing projects is intended to support sectors where the UK can lead globally. The funding package aims to provide certainty to investors, aligning with the government’s priority to foster economic growth, protect existing jobs, and create new opportunities.

Beatrice Barleon, head of policy & public affairs at EngineeringUK, acknowledged the government’s commitment to investing in crucial sectors but expressed disappointment in the lack of emphasis on skilling the future workforce. Barleon called for a clear and properly funded STEM skills plan, stressing the need for investment in careers outreach, education, and apprenticeships.

Overall, the Budget announcement underscores the government’s determination to fortify the manufacturing sector, stimulate innovation, and drive sustainable economic growth in the UK.